a shock is ahead for the housing market

A shock revelation ahead of last nights. Between the bidding wars and lack of homes for sale the 2021 housing market has been nothing short of a nightmare for many would-be buyers.

Pin On Real Estate And Mortgage News

A borrower who took on a 500000.

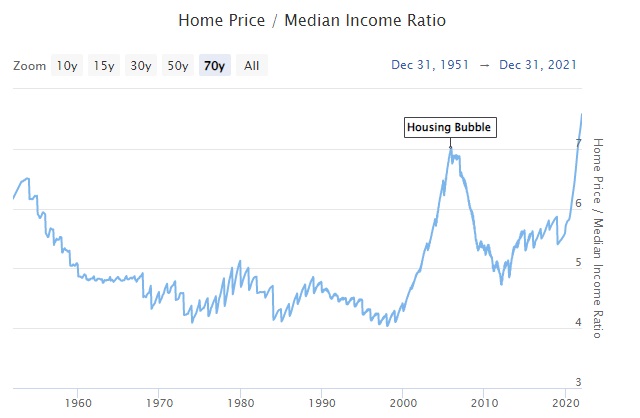

. Affordability is becoming an issue. The presentation featured a panel of industry veterans who discussed how to think ahead to and prepare for this development what macro-economic factors will influence the 2021 housing market. Consider the housing crash in 2007.

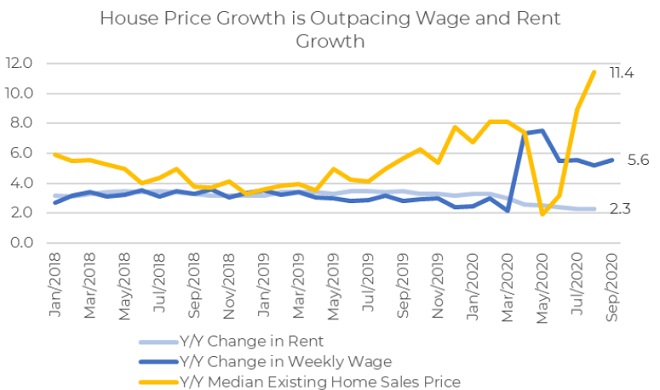

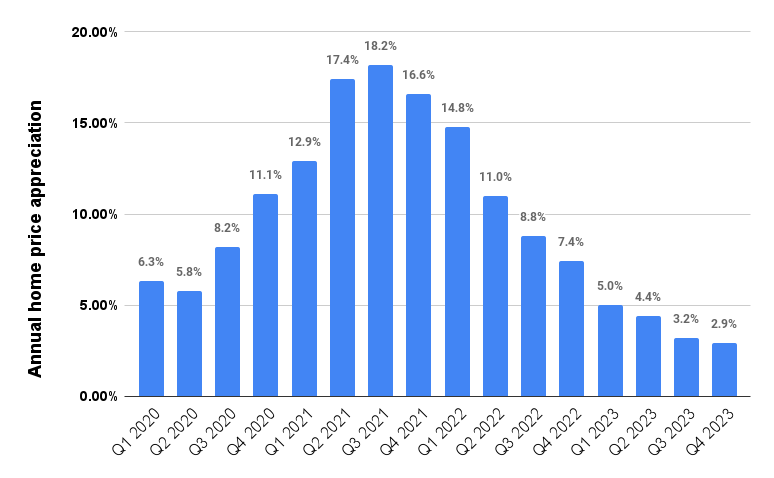

Bank of America is warning that high inflation poses a credible threat to the economic recovery that began just two years ago. A shock is headed for the housing market. It shows that home prices increased by 113 percent in 2020 and 159 percent in 2021 as a result of robust housing demand and record low mortgage rates.

The Block price shock highlights Australias housing market insanity. So if even a small percentage of these 17 million struggling borrowers opt to sellrather than returning to. The message from the Federal Reserve is pretty clear.

In June 2021 home prices across the US. The ONS figures put the average house price in December at 274712 - thats up 27000 in a year. But if a borrower got that loan at a 5 rate that payment would.

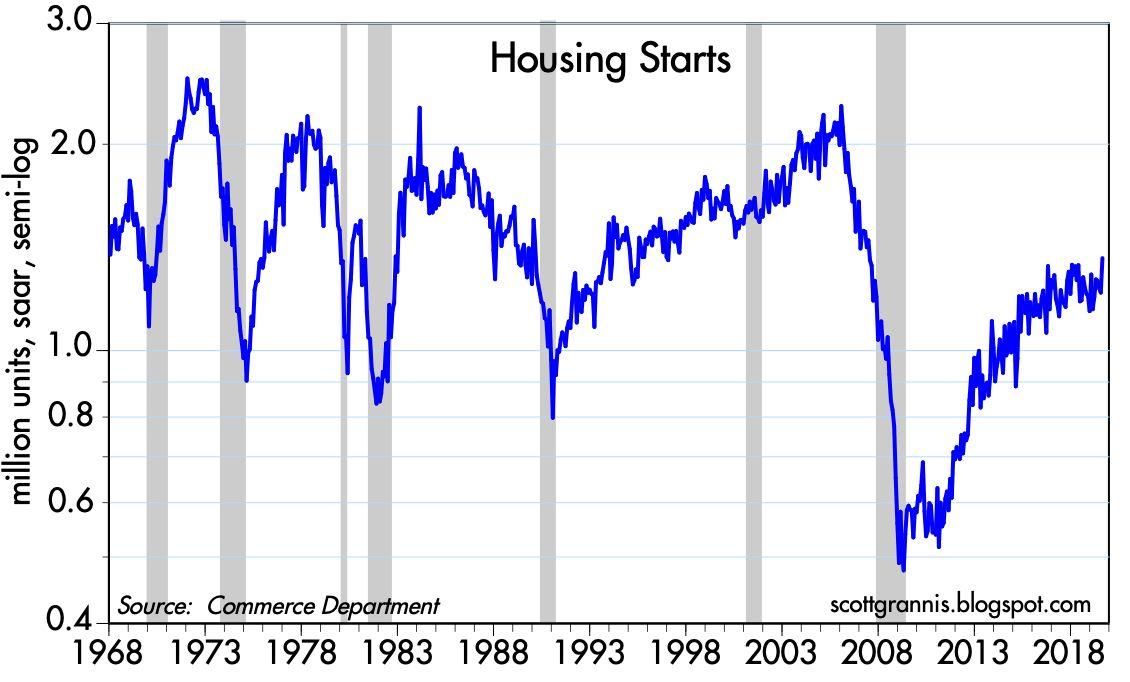

According to Freddie Macs recent housing forecast house value growth in 2022 will be less than half of what weve witnessed last year. On Thursday it hit 527the highest level since 2009. Opening the economy is going to be very educational for recent first-time home buyers.

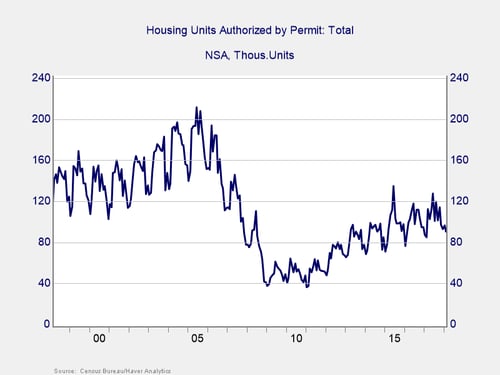

At a 311 rate a borrower would owe 1710 per month on a 400000 mortgage. At one point this spring housing inventory was at a four-decade low. Thats a bigger deal than it might first appear.

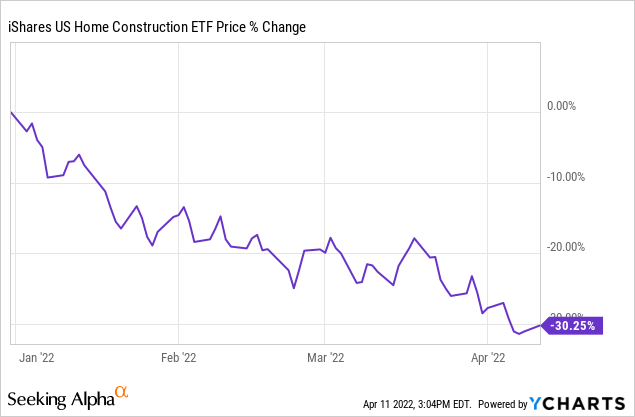

Thats a 46 jump. After all just look at what its doing to mortgage payments. Industry insiders tell Fortune this swift move up in mortgage rates amounts to an economic shock.

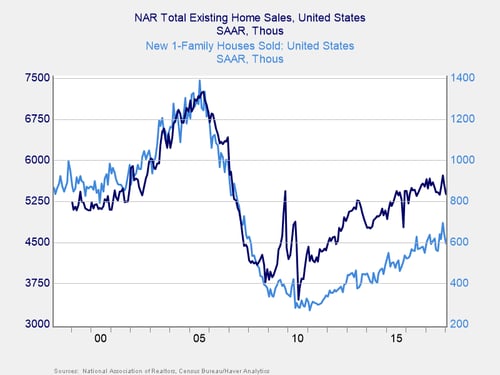

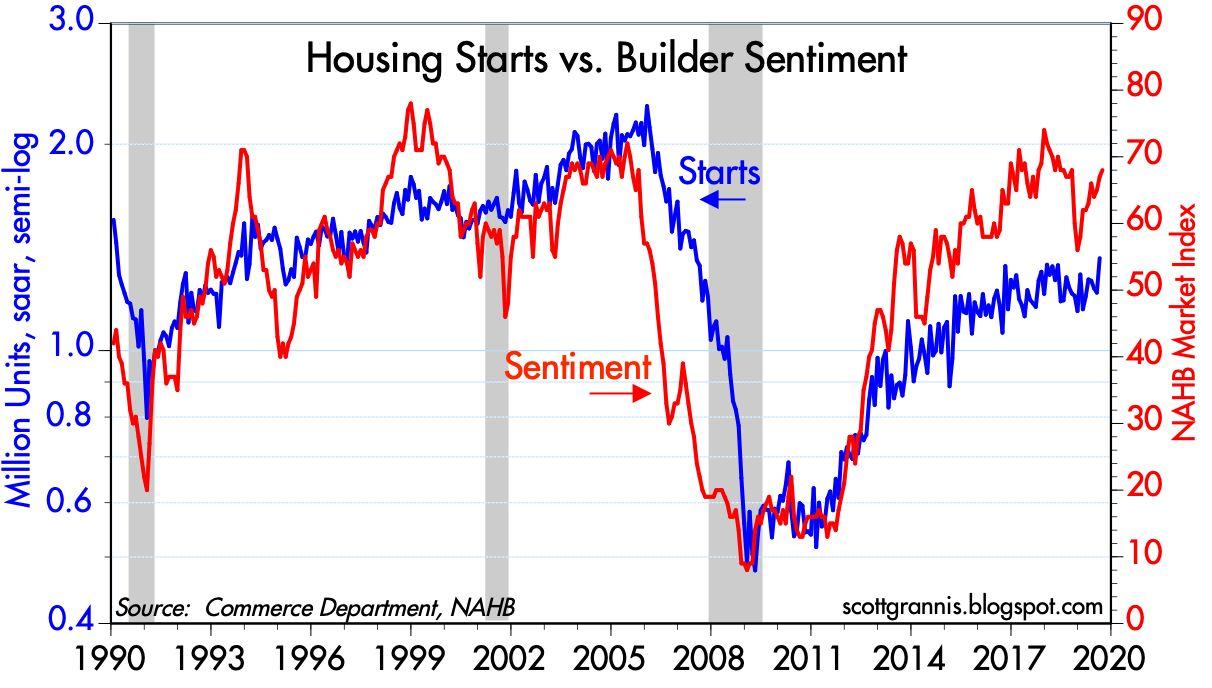

While the housing market might start to see small shocks ahead with the forbearance program ending next month lenders have strict guidelines they are required to follow and a sharp increase in foreclosures does not appear to be likely. In fact this year housing inventory hit a 40-year low. In many ways the rise and fall of major stock indexes can trigger a variety of actions and behaviors that can indirectly affect the way people choose to buy and sell their homes.

Surged 248 year-over-year to a median sale price of 386888 according to Redfin. You can see. Since the Fed is rushing to hike the US into a deep recession just so inflation will supposedly slide ahead of the November midterms in line with Bidens demands the housing market is eager to comply with Powells and Bidens handlers wishes and is leading the charge into the economic abyss as we discussed most recently here and as the latest nationwide.

For buyers high housing price jumps have translated into sticker shock Ratiu said noting that the monthly payment for a 30-year mortgage on a median-priced home is 550 higher than it was a year ago. The pandemic was the worst thing ever to happen. Home sales and prices even grew during the US.

The Biden-Harris administration has made it clear it has no plans for another extension of the mortgage forbearance program which is set to lapse on Sept. Instead I think home prices will rise by closer to 8 in 2022 not 16 like it did in 2021. Even before this expected wave of new inventory the red hot housing market is starting to lose some steam.

Bond-tapering and Fed rate hikes started on March 16 2022. The pandemic depressed housing inventory last year just as new buyers driven by historically low interest rates and remote work began flooding the marketThe result was a classic supply-and-demand scenario where scarcity drove competition and subsequently prices to new highs. If a borrower took out a.

Supply versus demand. At this stage were not expecting property prices to drop but there could be tough times ahead for the housing market. But the red-hot market is finally starting to cool down.

Meanwhile house prices are high. Of course rising mortgage rates should price out more homebuyers and take some steam out of the housing market. Housing market has proven to be incredibly resilient in the face of recent pandemics and the economic shock that followed the 911 terrorist attacks.

April 13 2022 1256 AM 3 min read. Average house prices were up 108 per cent in the year to December up very slightly from 107 per cent a month earlier. Implications for Todays Market and COVID-19.

This pace of double-digit price appreciation in the housing market is unsustainable. However the area-specific data particularly about the number of homes under. Historically real estate has proven very resilient with median home prices declining in just eight of the past 60 years.

Recession from March 2001-November 2001. The economic shock hitting the housing market is starting to do some damage.

Real Estate Housing Market Crash Housing Bubble Factors Signals Predictions

Is The Housing Market Rolling Over

Housing Shortage And Low Interest Rates Are Driving Up House Prices Raboresearch

Robert Shiller Says The Housing Market Will Crash No One Else Seems To Think So Seeking Alpha

Why Despite The Coronavirus Pandemic House Prices Continue To Rise The Economist

No Housing Market Bubble Seeking Alpha

A Shock Is Headed For The Housing Market

The Real Estate Market In Charts Real Estate Marketing Property Marketing Chart

No Housing Market Bubble Seeking Alpha

California Housing Crash Searches Surge

Real Estate Housing Market Crash Housing Bubble Factors Signals Predictions

The Housing Market Just Hit A Level Not Seen Since 2007

Either Zillow Is Broken Or We Re In A Massive Housing Bubble

Is The Housing Market Rolling Over

The Unassuming Economist House Prices In New Zealand

The Housing Market Could Crash In 2023 Propertyonion

The Housing Market Could Crash In 2023 Propertyonion